For most people, deciding how to invest their hard earned money seems all too difficult. They’d rather spend their time praying for the winning lotto numbers than reading through pages and pages of financial research, and quite frankly I don’t blame them!

However, so long as you apply a few key principles, investing doesn’t have to be as hard as all the gurus make it out to be.

This article will simplify the investment world for you and hopefully arm you with the knowledge that you need to succeed.

One of the most important decisions one can make both in the years saving up for retirement as well as during retirement, is deciding how to invest their money.

Just about all investments can be classified into just two categories “Stable” and “Volatile”.

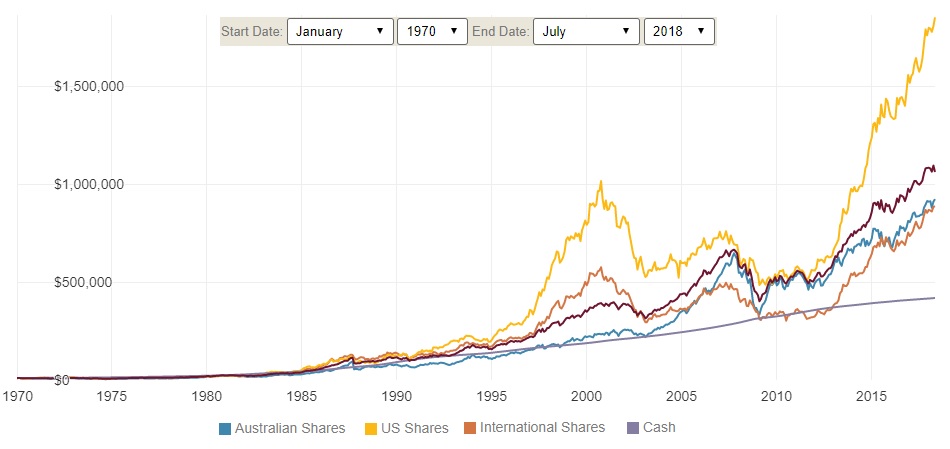

Stable investments are those whose values do not tend to fluctuate up and down much (such as cash based investments like bank deposits). Because of this they are considered more conservative investments but as you will see from the graph below, they also have a history of producing lower long-term returns.

Stable investments are those whose values do not tend to fluctuate up and down much (such as cash based investments like bank deposits). Because of this they are considered more conservative investments but as you will see from the graph below, they also have a history of producing lower long-term returns.

Volatile investments on the other hand, do tend to fluctuate up in down in value in the short term (such as shares). Because of this they are considered to be more aggressive (or riskier), but again as you will see from the graph below, they have a history of producing higher long-term returns.

source: Vanguard interactive index chart

source: Vanguard interactive index chart

www.vangaurdinvestments.com.au/VolatilityIndexChart/ui/advisor.html

Other interesting facts provided by andexcharts.com.au reveal that:

- The share market in Australia has outperformed cash:

- 68% over all one year investment periods,

- 84% of the time for all 5 year investment periods,

- 92% of the time for all 10 year investment periods, and

- 99.87% for all 20 year investment periods

- The Australian share market has also never lost money over periods greater than 10 years.

So, why do all these number matter?

Put simply, investing too conservatively could mean your money doesn’t keep up with inflation and will run out sooner due to lower long-term returns. On the other hand, investing too aggressively could mean disaster if markets crash and you need to cash in your investments.

So what should you do?

Well, whilst past performance does not guarantee future results, we can still take some very important lessons from the past. The biggest lesson we can learn is that the longer you hold your growth assets, the less likely you are to lose money.

People often get caught up with short term price movements and panic themselves into buying and selling based on those short term movements.

The fact is, trying to consistently pick the bottom or top of the market has proven to be impossible for even the greatest investment minds in the world.

Investing in higher risk assets such as shares and property is not about chasing last years hottest performing thing (in fact the evidence suggests that this often leads to poorer performance). It’s about taking a long term view and having the discipline to stay the course.

If you know you can’t invest your money for a long period of time (7+ years) or you simply do not have the discipline to ride the ups and downs, then you may want to consider more stable assets such as cash based investments.

So the first decision when it comes to investing is deciding how much money you want to put into each category (i.e. stable versus volatile).

The three bucket strategy

Our preferred investment methodology is to break up our client portfolio’s into the following 3 distinct buckets:

In bucket number 1 (Cash bucket) we put 12 months worth of cash-flow needed. For example, let’s say you needed to draw $20,000 a year from your investments, we would put $20,000 in your cash bucket.

In bucket number 2 (Fixed interest bucket) we hold another 4-6 years worth of cash-flow needs in more conservative income producing assets.

In bucket number 3 (Growth bucket) we put the balance of your portfolio into growth investments like shares and property. The big difference with this third bucket is that these assets can be quite volatile in the short term, but are likely (yet not certain) to outperform conservative investments in the long term.

The above strategy therefore means you have 6 or 7 years of cash-flow set aside in conservative assets. This is important because if a major market downturn were to occur on your growth bucket (i.e. bucket 3), you have enough funds in the first 2 buckets to buy you time to ride out the market correction and wait for a recovery. In other words, you get to avoid having to sell those volatile assets in tough times, which is usually the worst time to sell.

The benefits of this approach are that:

- Your portfolio can be tailored specifically to you and your needs

- You get the certainty of income and cash flow from buckets 1 and 2

- You get the benefits of long term growth via the growth bucket

- You do all of the above whilst minimising your downside risk.

This model was tested during the GFC and our clients who adopted the above method were able to come though the GFC and see their portfolio recover whilst also having their income needs always being met by buckets one and two.

As i said earlier, if you know you can’t invest your money for a long period of time (7+ years) or you simply do not have the discipline to ride the ups and downs, then you may want to consider more stable assets such as cash based investments.

Broadly speaking, some other factors to also consider when deciding how much to put into each bucket include:

– your age.

– the level of your financial literacy.

– Your income and assets.

– your general goals and objectives.

These things will also play a part when deciding how much money should go into each of the three buckets described above.

Once you’ve made the decision of how much money to put into each bucket, the next step is decide what investments to purchase within each bucket. this is a much broader topic so it’s best you seek advice from a professional.

So there you have it, a simple guide to understanding investment risk. I hope you found it helpful!

If you’d more help planning for your financial future, click here to learn more about our free initial consultations.