Your risk profile is a measure of how comfortable you are investing your funds across different types of assets. There are various types of risk profiles, mainly distinguished by their overall allocation to Defensive and Growth assets.

Defensive investments are those whose values do not tend to fluctuate up and down as much (such as cash, term deposits, bonds and more). Because of this they are considered more conservative investments, but they also have a history of producing lower long-term returns.

Growth investments on the other hand, do tend to fluctuate up in down in value in the short term (such as shares and property). Because of this they are more aggressive (or riskier), but they have a history of producing higher long-term returns when compared to more defensive assets.

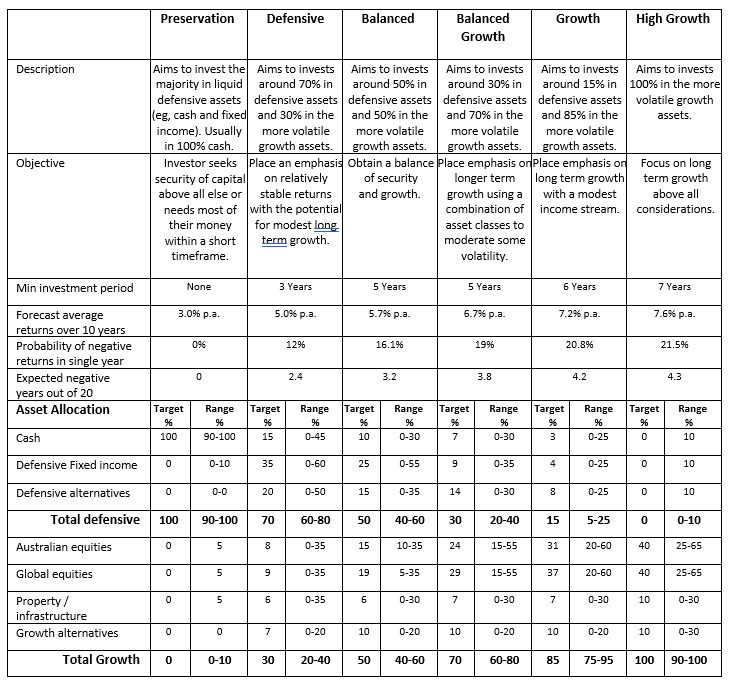

The table below provides compares some of the main types of risk profiles people tend to fit into.

If you would like some help deciding the best way to invest your funds tailored to your personal situation, feel free to contact us.